to get insurance quotes in your area

Get Life Insurance For Bipolar Disorder

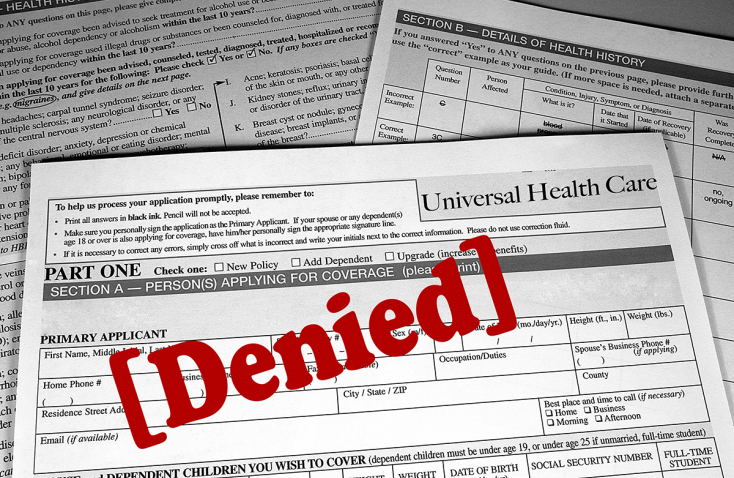

The problems that can come from life insurance for bipolar people are pretty common, but they can be solved. It is common for people with bipolar disorder to feel a need to get life insurance. It also needs to be mentioned that rates are generally higher for people with bipolar disorder and that sometimes people with bipolar order declined life insurance by insurance companies. Bipolar disorder does create added risk for the issuing company.

This is where life insurance brokers and underwriters can help. There are educated insurance brokers that can help you and have the knowledge and understanding to do so. Calling us at General Insurance is a great way to ask questions and get more information. Connecting with the right people and companies is a great way to move the process along.

When you get in contact with the right people to talk about life insurance for bipolar people, you will need to know the right questions to ask. In addition, you will want to know the questions that will be asked of you and what the actual criteria are to approve or deny life insurance coverage for bipolar people.

There are a number of different types of bipolar disorder and each one is treated a little differently when it comes to life insurance coverage. Variables that will be considered when you make an application are:

- When the disorder was diagnosed

- Medication and how well it is working

- Therapy and how well it is working

- The type of the disorder it is

- The severity of the disorder

An accurate diagnosis and effective treatment can go a long way in treating bipolar disorder. It can also go a long way in getting life insurance when you have bipolar disorder. If you are able to demonstrate the ability to comply with a treatment plan that works, it is easier to convince the underwriters to approve your application.

Some Of The Criteria for Life Insurance When Bipolar

For people who have bipolar disorders that want life insurance, there are a number of criteria that need to be met. While insurance companies weight things differently there are some things that will help or should be expected across the board. Here are some things you should expect to accomplish in order to receive life insurance coverage:

- Be ready to release all medical records to the life insurance company if they are requested.

- Be taking medication and receiving treatment as needed and directed by your doctor or therapist. If you have been diagnosed more recently, you may need to wait. This is so you can demonstrate that you are receiving and complying with medication and treatment,

- Having an insurance broker that will advocate for you with an underwriter goes a long way. It is a very good idea to have one.

- Discussing personal details about your life, and talking about positive things such as a stable job and/or relationship.

You are not likely to be approved if one or more of the following conditions apply:

- You have attempted suicide, or have a history of attempting suicide.

- You have suicidal thoughts.

- You have both bipolar disorder and certain other health problems as well.

- If you have or have had substance abuse problems.

- You are on disability for your disorder.

- You have been in the hospital often due to your bipolar disorder.

One of the reasons that life insurance for bipolar people can be hard to find is the risk of suicide. In addition, you should note that many life insurance policies are void in the event of a suicide. The fact that it does not always make the life insurance policy void is a change from the past, there are more options where this doesn’t happen now.

If a suicide happens, and the person being insured commits suicide early in the policy, the people listed as beneficiaries may get a return of some premiums paid. They will not, however, receive the payout itself. Once the time period listed has passed, the full benefit would be paid. This applies if the policy does not explicitly exclude suicide. You may need to spend some time looking for a company that does not exclude suicide. If/when you find one, the added expense can be worth the insurance.

Varying degrees of bipolar disorder

Living with bipolar disorder or with a family member who endures is can be challenging at times, especially if the disorder is severe. It’s worth noting that, like many ailments, Bipolar disorder can present itself in varying degrees of severity, ranging from something that is easily and effectively treatable with medications to instances that require hospitalization and ongoing care from medical professionals.

Where Bipolar Disorder does vary from most other medical conditions, is in the fact that its severity can change not only from month to month or day to day but from increments as small as minute to minute. Making sure your insurance covers you for conditions more severe than what you are currently experiencing is essential for two important reasons.

First, your condition may change suddenly, and having coverage for emergency services or other hefty expenses you did not expect to incur, gives you greater peace of mind in the moments when you find out you do need it. Second, if you are in the midst of a bipolar episode, you are less able to properly navigate insurance coverage decisions than you are right now. So addressing your needs in advance is essential to acquiring useful cost-effective coverage.

Three Strategies For Acquiring Insurance For Bipolar Conditions

- Act Now: getting proper coverage takes time. You need to obtain free quotes via GeneralInsurance.com and then take a moment to read through them or to ask questions about the coverage so that you can choose the policy that is right for you.

- Get More Coverage Than You Currently Need: keep in mind with bipolar disorders your coverage needs can change very quickly, and having coverage that properly handles the “worst case scenarios” means you can maintain peace of mind whether you are currently experiencing an episode or are enjoying the best of times right now!

- Professional Insurance Experts Can Help You: A lot is not yet known about the workings of the human mind, and some cases require medical knowledge Doctors simply do not have yet, but Insurance is quite different. On the insurance side of things, everything is already known, so speaking with an Insurance Expert at GeneralInsurance.com can save you a lot of time, angst and expense. It’s fast easy and free!

Final Note

It is possible to get life insurance when bipolar disorder impacts your life. Often it is difficult, but the time it takes to research and find a good match is something that many people do. It is a lot more likely for insurance companies to approve people that have bipolar disorder if the right conditions are met. This is because there has been great progress in the understanding of bipolar disorder and how it works. Some people have even said that as it has been studied it has been realized that is not always as serious as it was once thought.

People that have bipolar disorder may even be able to choose between term and whole life insurance coverage. At General Insurance, we are happy to speak with you about life insurance and answer any questions you have. While having additional health concerns in conjunction with bipolar disorder can lead to being denied life insurance coverage, this is not always the case. The only way to find out if you qualify is to talk with a knowledgeable agent. An insurance broker can also help.

We are looking forward to speaking with you further about your insurance needs! Choosing the right company that can give the best insurance policy that can fit your needs is a life decision that has an impact. If concern about getting life insurance because you suffer from bipolar disorder has been preventing you from reaching out to companies, please consider reaching out to us. There is no reason having bipolar disorder should exclude you from getting the insurance coverage you desire. In addition, we can talk with you about options that we have. Looking forward to serving your insurance coverage needs.

Add new comment